Patients who do not have insurance coverage or have an insurance plan that does not cover Trulicity can expect to pay significantly more. Some states have lower copays for Medicaid or entirely remove the copay requirement.

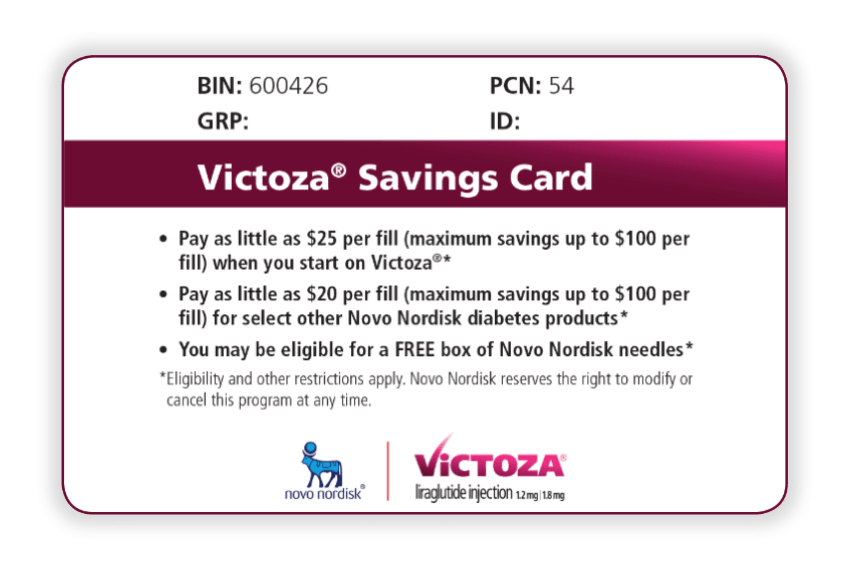

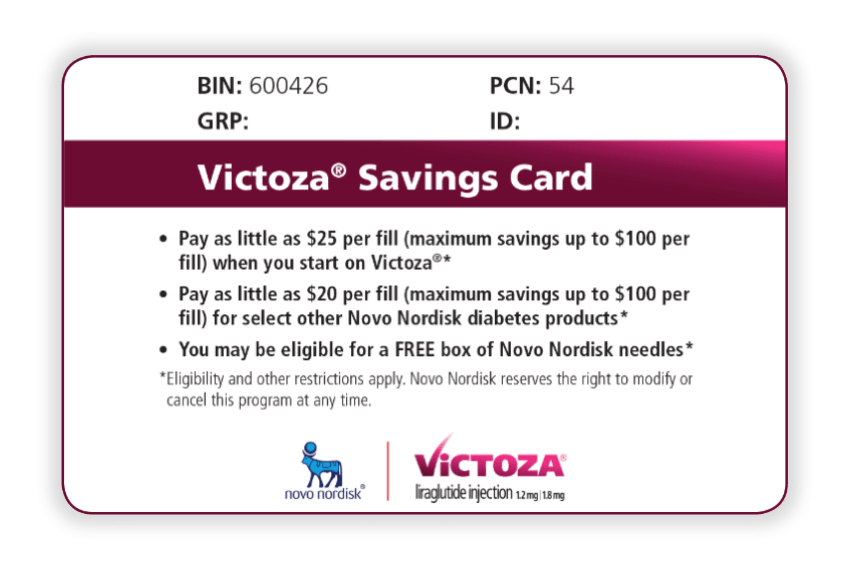

Medicaid: Most patients who Medicaid covers will pay an average of $4-$9 per month. This can reduce the monthly cost to $4-$9 per prescription. The manufacturer offers an Extra Help assistance program to patients who meet certain eligibility requirements. The other 30% of patients will spend an average of $207 out of pocket. Around 70% of patients who are covered by Medicare Part D will spend between $0-$100 per month. Medicare Part D: Costs can change throughout the year depending on the phase of Medicare Part D coverage. People with insurance who meet certain qualifications may be eligible for a manufacturer savings card that can reduce the cost to around $25 per month, although maximum savings apply, and the cost may be more. These costs may be more for high-deductible plans. Others on the same type of plan may spend an average of $239 per month. Employer-provided or private insurance providers: Trulicity costs between $0-$30 per month for 92% of patients. Trulicity copays and costs for people with insurance depend on plan specifics but can have a wide range: Patients should check with their insurance company to determine if Trulicity is covered. Patient out-of-pocket costs and copays also vary.

It is fully or partially covered by many types of commercial health insurance, Medicaid and Medicare.

Insurance plans do not always cover Trulicity.

0 kommentar(er)

0 kommentar(er)